What Is Advance Ruling In GST And Procedure To Apply

Advance Tax Ruling is the interpretation of the tax laws in written and tax authorities issue these rulings to the corporations and individuals who are seeking more clarity on tax matters. Understanding every provisions of a tax law is not everyone’s cup of tea and therefore when an individual finds himself incapable of understanding about certain provision, advance ruling in GST comes into the picture.

The Purpose of advance ruling is to enable an applicant in planning his activities that would come under the purview of GST. The individual also gets to know his tax liability as the ruling given by the Authority for Advance ruling is binding on the applicant as well as Government authorities. Individuals who are looking for advance ruling can do so without incurring high cost.

Why Advance Ruling?

It offers a view of tax liability well in advance in connection to a future activity to be performed by the applicant.

Advance Ruling can also be used to interest the Foreign Direct Investment as the big investors would always like to know about their future tax liability

Curbs the possibility of litigation and legal disputes

Helps in making right decision in timely manner.

Time Period for the Applicability

There is not time limitation for which the Advance Ruling should stay valid. Instead, it can remain valid till the period when the law, circumstance and the facts are in favor of the original advance ruling which has not changed.

However, in case the AAR or AAAR finds out that the ruling was obtained by the applicant through force or fraud, it can be held as ab initio void. Same goes if the Advance Ruling was obtained by misrepresenting the fact or nor disclosing the important facts. If such a situation arises, all the provision of the CGST/SGST Act would be applicable on the applicant as if advance ruling was never made. Declaring the Advance Ruling void can only be done after the hearing of the applicant.

Procedure for Registration of Advance Ruling

- Click the ‘Home’ ab on the GST Portal https://www.gst.gov.in/

- Fill in the general Details as shown below:-

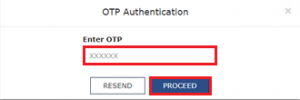

- In the Verify OTP page, enter the Mobile OTP and Email OTP and click the PROCEED button.

On successfully entering the OTPs, a message tab would appear like this:-

4. After the ID is created, click the Services> Payment > Create Challan The Create Challan page is displayed. In the GSTIN/Other ID field, enter the ID created for the Advance Ruling

Enter the captcha text and click the PROCEED button.

- There would be a FEES column in the challan page, enter the amount of Rs 5000/- for both CGST and SGST.

Select Mode of payment and click the GENERATE CHALLAN Button

An OTP will be sent to the mobile phone number

- Enter the OTP in the OTP Authentication box and click the PROCEEDbutton

- Once the OTP is successfully entered, Challan would be generated

Then click MAKE PAYMENT button

After the Payment is done, it can be tracked in the Services > Payment > Track Payment Status command.

- After making the payment, click the Downloads > Offline Tools > GST ARA 01 – Application for Advance Ruling command.