Public helpful

How to Get the FASTag Annual Pass: Benefits,…

FASTag Annual Pass by IHMCL: Unlimited Toll Access for Personal Vehicles Across India: In a major…

Human Metapneumovirus (HMPV): Symptoms, Prevention, and…

Human Metapneumovirus (HMPV): A Comprehensive Overview Human Metapneumovirus (HMPV) is a respiratory…

How to Apply for a QR Code-Enabled PAN Card under PAN…

How to Apply for a PAN Card with Enhanced QR Code under PAN 2.0 The PAN 2.0 initiative by the Indian…

Your Number Will Be Barred in 2 Hours: Exposing the…

You receive a call or SMS from an unknown number claiming to be from your telecom provider. The…

How to file a caveat in the Supreme Court of India ?

Filing a caveat in the Supreme Court of India is a precautionary legal measure taken by a person who…

400/220 KV Line installation and Plea of Victims

This page is created to give information to the victims of 400 KVA/ 220 KVA line which is proposed…

International Gold Trading scam | XAUUSD Times Business…

There are many advertisements available on Facebook claiming free stock recommendations. These ads…

Fraud call in the name of Fedex, Drugs and Aadhar…

Fraud call in the name of Fedex I Drugs and Aadhar misuse: You will be shocked to get spam calls in…

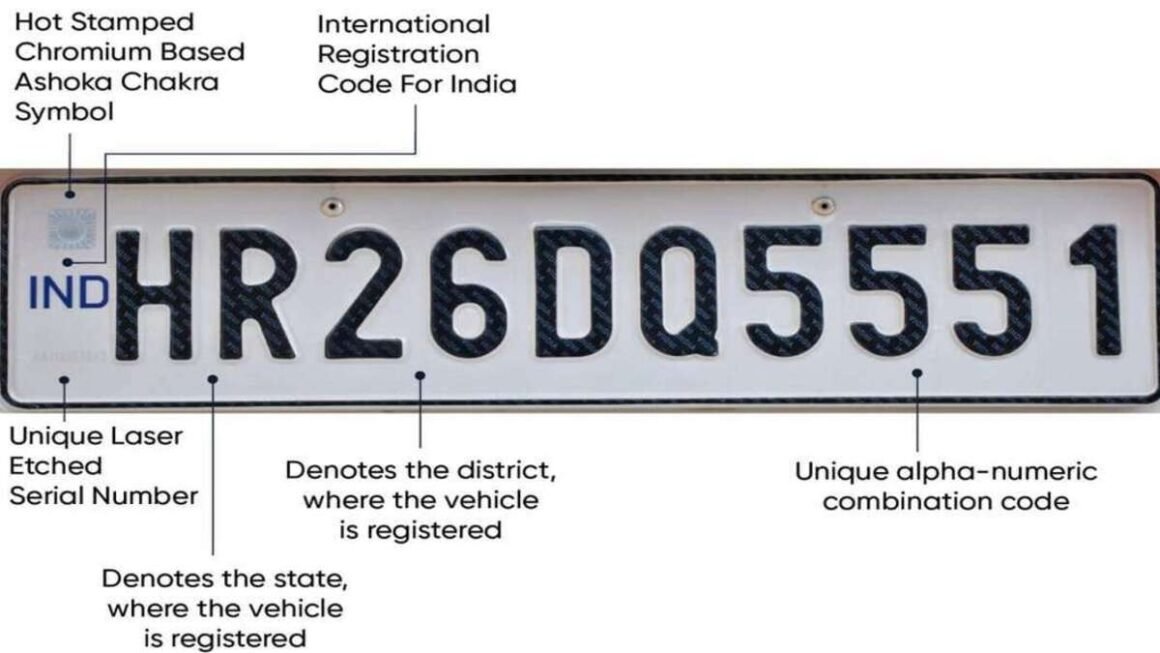

How to get HSRP to your Vehicles ?- Two and Three…

PUBLIC NOTICE KIND ATTENTI ON : VEHI CLE OWNERS As per the Government of Karnataka…

OLA S1 Pro charger refund is waiting

The ministry has asked the OEMs to offer a refund to customers for the amount they've paid for…